do pastors pay taxes on love offerings

Do pastors pay taxes on love offerings. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

Staycation Bible School 2020 Feet That Follow The Presbyterian Outlook

If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it.

. If a love offering is made to compensate a pastor for services previously performed then it is taxable. How do pastors file taxes. If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it.

Do pastors pay taxes on love offerings. If a love offering is made to compensate a pastor for services previously performed then it is taxable. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax.

Do pastors pay taxes on love offerings. Do Pastors Pay Income Tax. As a church we do not have to pay any taxes for a pastors salary that responsibility lies with the.

To properly handle love offerings and to protect pastors who serve them church congregations must recognize that the love offerings given to the pastors may constitute taxable income. Do pastors pay taxes on love offerings. Do pastors pay taxes on income.

The answer depends on the donors intent. 1 hour agoIt is essential that all pastors pay both employer-employer taxes and employees-employee taxes. He decides not to take a salary but lets the church members know that there will be blue envelopes that can be used to give him a gift or love offering.

Were taxable income based on these factors. The church is out of it then. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it is non-taxable. Do pastors pay taxes on love offerings. Source of the gifts.

Do pastors pay taxes on love offerings. If donors give their love gifts directly to the ministerit is between that minister and the IRS how it is reportedbut as Anonymous stated. If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it.

Do pastors pay taxes on love offerings. If a love offering is made to compensate a pastor for services previously performed then it is taxable. If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it is non-taxable.

Do pastors pay taxes on love offerings. To properly handle love offerings and to protect pastors who serve them church congregations must recognize that the love offerings given to the pastors may constitute taxable income. His people like him.

Cannot be a tax deduction for the donor. If a love offering is made to compensate a pastor for services previously performed then it is taxable. In total 15 dollars are required for Medicare taxes.

If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it is non-taxable. In addition there is a 4 tax on Social Security contributions. If you were to ask Should pastors pay taxes on love offerings then the answer would probably be Yes I say probably as it may well depend upon which country the pastor is in as each country has its own tax laws.

If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it. In 2018 that will be 12. They give him gifts.

Do pastors pay taxes on love offerings. Love offerings to active ministers are generally taxable compensation and not tax-free gifts. However under some circumstances a love offering may be a tax-free gift.

In the Goodwin case and the Banks case the courts ruled that the special love offerings given to the pastors on special occasions such as Christmas birthdays anniversaries etc. A pastor starts a church. If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it is non-taxable.

If a love offering is made to compensate a pastor for services previously performed then it is taxable. To properly handle love offerings and to protect pastors who serve them church congregations must recognize that the love offerings given to the pastors may constitute taxable income. The blue envelopes will go directly to him as a gift and not the church so they will not be tax deductible.

No matter what role you play in your ministry as an employee a self-employed person or a full-time minister all of your earnings are subject to tax including wages and offerings as well as any fees received for. If a love offering is made to compensate a pastor for services previously performed then it is taxable. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax. Do pastors pay taxes on love offerings. To properly handle love offerings and to protect pastors who serve them church congregations must recognize that the love offerings given to the pastors may constitute taxable income.

If a love offering is made to compensate a pastor for services previously performed then it is taxable. If the love offering can be characterized as detached and disinterested generosity to show affection respect admiration or charity then it is non-taxable. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

Do pastors pay taxes on love offerings. If a love offering is made to compensate a pastor for services previously performed then it is taxable. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

If you take up a love offering through the church it is usually taxable and should be reported on the recipients W-2.

No You Should Not Love Your Neighbour As You Love Yourself Psephizo

Are Love Offerings Taxable To The Recipient Church Shield

10 Gifts Your Pastor Will Love Pastor Appreciation Gifts Pastor Appreciation Day Youth Pastor Gifts

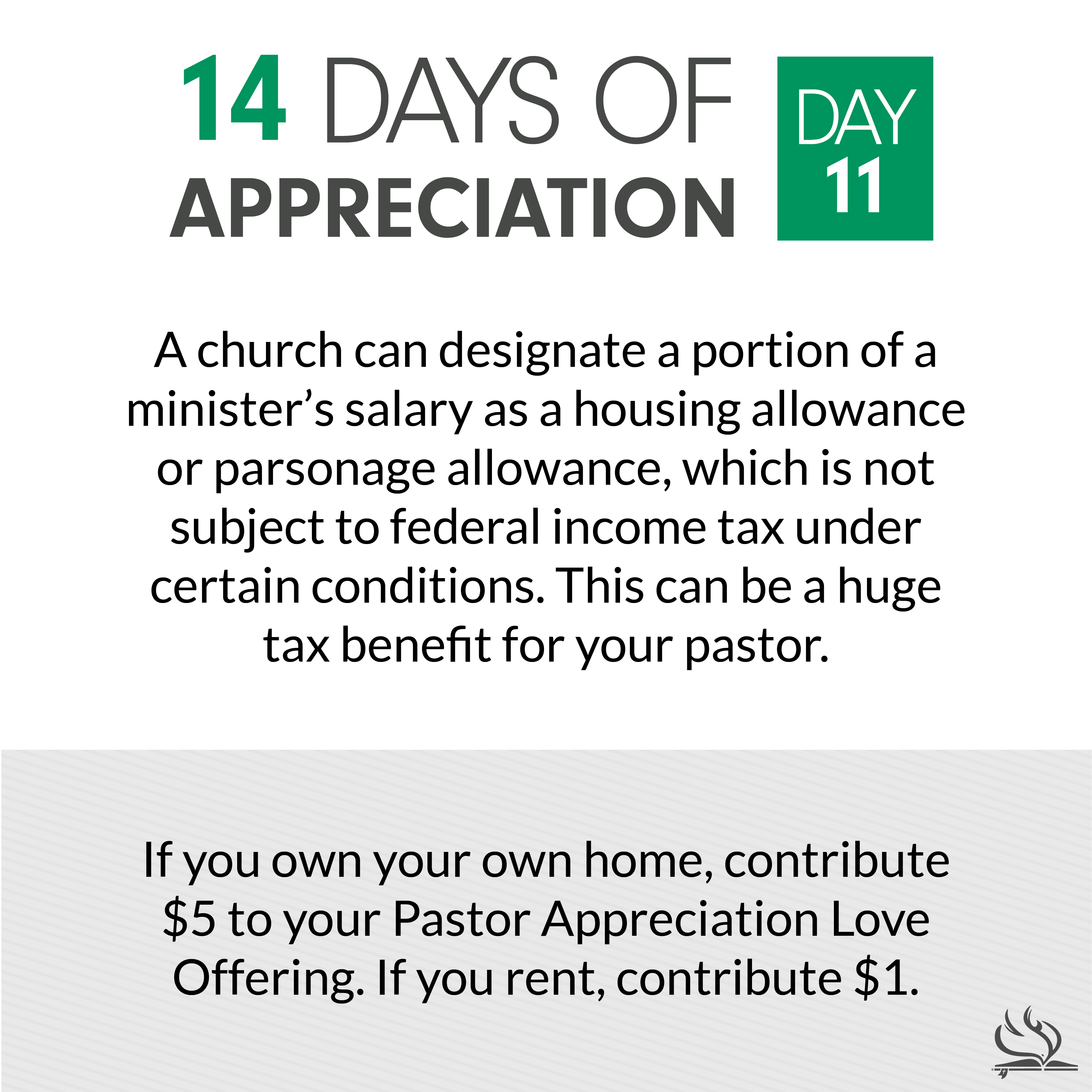

14 Days Of Appreciation Compass Initiative

The Pastor Dies And Is Only Resurrected If She Receives Enough Offerings R Facepalm

Following The Rules For Love Gifts Church Law Tax

The Top Bible Verses About Loving Everyone In Scripture

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

The Zimzum Of Love A New Way Of Understanding Marriage By Rob Bell

Matthew And Work Bible Commentary Theology Of Work

Pin On Church Management Software

Love Offerings Gifts Taxable Or Not

Love Offerings Gifts Taxable Or Not

Startchurch Blog A Simple Guide To Giving Love Offerings

Pastor S Love Offering Gift Or Taxable Income The Pastor S Wallet

Five Things You Should Know About Pastors Salaries Church Answers